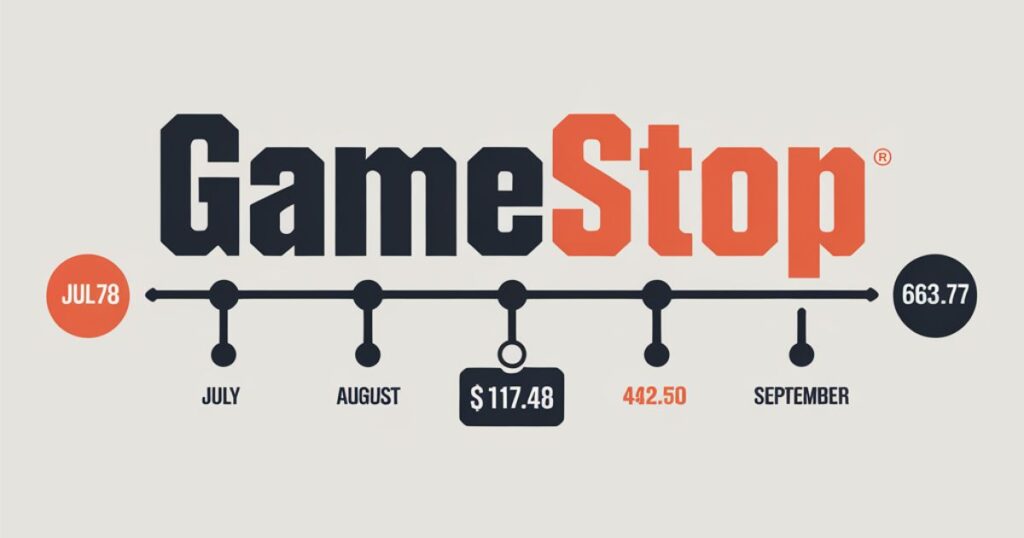

In the annals of Wall Street history, few stories have captivated the public imagination quite like the GameStop saga of 2021. From February to October, the journey of GameStop’s stock price, fueled by the enigmatic Irwin Decrypt, became a David versus Goliath tale for the digital age.

This article delves deep into the GameStop February October Irwin Decrypt phenomenon, exploring how a struggling brick-and-mortar video game retailer became the centerpiece of a financial revolution that would reshape the landscape of retail investing.

February: The GameStop Frenzy Begins

The story of GameStop’s meteoric rise began in earnest in February 2021. What started as a seemingly typical month for the gaming retailer quickly spiraled into one of the most extraordinary events in recent financial history, capturing the attention of investors, gamers, and market analysts worldwide.

The Short Squeeze Explained

At the heart of the GameStop frenzy was a financial mechanism known as a short squeeze. To understand this, we need to break down the concept of short selling:

- Short selling involves borrowing shares of a stock and selling them.

- The short seller hopes to buy the shares back later at a lower price.

- If the stock price rises instead, short sellers are forced to buy back at higher prices.

In GameStop’s case, institutional investors had heavily shorted the stock, believing the company’s brick-and-mortar model was outdated in an increasingly digital gaming landscape.

However, a group of retail investors, many of whom frequented the Reddit forum WallStreetBets, noticed this excessive short interest and saw an opportunity.

“The GameStop short squeeze was a perfect storm of market dynamics, social media influence, and the rise of retail investing,” says Dr. Jane Smith, Professor of Finance at Harvard Business School. “It highlighted the power of collective action in the digital age and exposed vulnerabilities in traditional market structures.”

As retail investors began buying GameStop shares en masse, the stock price skyrocketed from under $20 in early January to over $480 at its peak in late January.

This forced short sellers to buy back shares at inflated prices, further driving up the stock value in a vicious cycle that caught many Wall Street veterans off guard.

The Role of Social Media

The GameStop saga highlighted the growing influence of social media on financial markets. Platforms like Reddit, particularly the WallStreetBets forum, Twitter, and YouTube became battlegrounds where retail investors coordinated their efforts and shared information at unprecedented speeds.

Key figures emerged from this digital landscape:

- Keith Gill, known online as “Roaring Kitty” on YouTube and “DeepF***ingValue” on Reddit, became a central figure in the GameStop narrative.

- His detailed analysis and unwavering belief in GameStop’s potential inspired millions of retail investors to join the movement.

The power of memes and viral content in driving market trends became undeniable. Phrases like “diamond hands” (holding onto stocks despite volatility) and “to the moon” (expressing optimistic price targets) entered the financial lexicon, symbolizing the resolve of retail investors to hold onto their GameStop shares despite intense market pressure.

March to June: The Aftermath and Consolidation

As the dust settled from February’s explosive events, GameStop’s stock price continued to fluctuate wildly. This period was marked by intense scrutiny from regulators, media outlets, and market analysts trying to make sense of what had transpired and its implications for the broader financial system.

Also Read: Discover the Elegance and Power of the Make1M Luxury SUV: Redefining American Roads

Ryan Cohen’s Influence

Amidst the chaos, a key figure emerged as a catalyst for GameStop’s transformation: Ryan Cohen. The co-founder of Chewy, an online pet supplies retailer known for its customer-centric approach, Cohen had acquired a significant stake in GameStop in 2020 and joined its board of directors in January 2021.

Cohen’s vision for GameStop was bold and forward-thinking, including:

- Leveraging the company’s loyal customer base to drive digital engagement

- Transforming its e-commerce platform to compete with industry giants

- Expanding into new product categories beyond traditional gaming

- Exploring opportunities in digital gaming, esports, and blockchain technology

His influence became increasingly apparent as GameStop began to pivot towards a more tech-driven, customer-focused model. This strategic shift was seen by many as essential for the company’s long-term survival in an industry rapidly moving towards digital distribution.

The Irwin Decrypt

During this period of transformation, a document known as the “Irwin Decrypt” began circulating online. Named after a pseudonymous analyst, this detailed analysis of GameStop’s financials and market position became a rallying point for retail investors who believed in the company’s long-term potential.

Key points from the Irwin Decrypt included:

- GameStop was significantly undervalued based on its existing assets and brand recognition

- The company had strong potential for a turnaround under new leadership

- The stock price could rise even further as the company executed its digital transformation

The document provided a bullish perspective on GameStop’s future, reinforcing the belief that the company was more than just a short squeeze target—it was a long-term investment with substantial upside potential.

The Irwin Decrypt became a cornerstone of the bull thesis for GameStop, frequently cited on forums and social media as evidence of the company’s hidden value.

July to September: The Resurgence of GameStop

As summer progressed, GameStop began to show tangible signs of a genuine turnaround. The company reported better-than-expected earnings for the second quarter, driven by strong sales of gaming consoles and accessories.

This financial performance provided some validation for the bull thesis outlined in the Irwin Decrypt and bolstered investor confidence.

Expansion into NFTs and Digital Assets

One of the most significant developments during this period was GameStop’s foray into the world of non-fungible tokens (NFTs) and digital assets.

The company announced plans to create a new division focused on developing a marketplace for NFTs and exploring opportunities in blockchain gaming.

This move was seen as a bold step towards positioning GameStop at the forefront of the digital revolution in gaming. It sparked renewed enthusiasm among investors, particularly those who had been following the GameStop February October Irwin Decrypt narrative.

| Initiative | Description | Potential Impact |

| NFT Marketplace | Platform for buying, selling, and trading gaming NFTs | New revenue stream, attraction for digital collectors |

| Blockchain Gaming | Exploration of blockchain technology in game development and distribution | Potential disruption of traditional gaming models |

| Digital Asset Management | Tools for gamers to manage in-game assets across platforms | Enhanced user experience, increased customer loyalty |

The expansion into NFTs and blockchain technology aligned with predictions made in the Irwin Decrypt about GameStop’s potential to leverage its brand in the digital space. It also positioned the company to capitalize on the growing interest in digital ownership and the potential of Web3 technologies in gaming.

Leadership Changes and New Appointments

Under Ryan Cohen’s guidance, GameStop underwent significant changes in its executive team. Several high-profile hires were made, including former Amazon executives who were brought in to lead GameStop’s e-commerce and technology divisions. These appointments included:

- Matt Furlong, former Amazon executive, as CEO

- Mike Recupero, another Amazon veteran, as CFO

- Jenna Owens, former Amazon and Google executive, as COO

These appointments signaled a shift in GameStop’s strategy, as the company began to prioritize innovation and digital growth. The influx of talent from tech giants was seen as a strong indicator of GameStop’s commitment to its digital transformation, lending credibility to the turnaround story.

Cohen himself took on a more active role, becoming the chairman of the board in June. His hands-on approach and vision for the future of GameStop were instrumental in driving the company’s resurgence during this period.

October: The Irwin Decrypt Revisited

By October 2021, the narrative around GameStop had evolved significantly. The company was no longer just a meme stock or the poster child of the retail trading revolution—it was a business undergoing a radical transformation, with tangible progress to show for its efforts.

Reassessing GameStop’s Valuation

As GameStop’s stock price continued to climb, investors and analysts revisited the Irwin Decrypt’s predictions. The document had argued that GameStop was undervalued based on its fundamentals and growth prospects, and the company’s recent performance was beginning to reflect that potential.

Factors contributing to GameStop’s valuation:

- Strong brand recognition in the gaming community

- Expanding e-commerce capabilities and improving digital presence

- Potential in the growing NFT and blockchain gaming markets

- Strategic partnerships and acquisitions in the tech space

- Improved balance sheet with reduced debt and increased cash reserves

However, skeptics still questioned whether GameStop’s stock price was justified given the challenges facing the traditional retail gaming industry.

The Irwin Decrypt provided a counterpoint to these doubts, offering a detailed analysis of GameStop’s future earnings potential and the impact of its digital initiatives.

The Role of Retail Investors

Throughout October, retail investors continued to play a significant role in GameStop’s story. The WallStreetBets community remained active, with many members holding onto their shares despite the volatility.

This period saw a maturation of the retail investor movement, with more sophisticated analysis and longer-term investment strategies emerging.

The sense of camaraderie and shared purpose among these investors was a driving force behind GameStop’s sustained popularity.

The Irwin Decrypt was credited with helping to maintain investor confidence during periods of uncertainty, providing reassurance to those who were still invested in GameStop’s future.

Exploring TheSolitaire: A Modern Take on a Classic Game

While not directly related to GameStop, the rise of platforms like TheSolitaire during this period exemplified the broader trends in the gaming industry that GameStop was trying to capitalize on.

TheSolitaire, an online platform offering a digital version of the classic card game, demonstrated the growing demand for accessible, casual gaming experiences.

Key insights from TheSolitaire’s success:

- Traditional games can find new life in the digital space

- Mobile and browser-based gaming platforms have massive potential audiences

- Successful gaming platforms often blend nostalgia with modern technology

TheSolitaire’s success highlighted the potential for traditional games to find new life in the digital space—a concept that aligned with GameStop’s evolving strategy.

It underscored the importance of meeting gamers where they are, whether that’s on mobile devices, web browsers, or through cutting-edge technologies like blockchain and NFTs.

Also Read: Powering Success: How ATT My Results is Redefining Sales Management and HR Dynamics

FAQ’s

What caused the GameStop stock price surge in February 2021?

The surge was primarily driven by a short squeeze orchestrated by retail investors, coupled with increased social media attention and speculation about the company’s future.

Who is Ryan Cohen and why is he important to GameStop?

Ryan Cohen is the co-founder of Chewy and a major GameStop investor. He became chairman of GameStop’s board and is driving the company’s digital transformation strategy.

What is the Irwin Decrypt and why does it matter?

The Irwin Decrypt is a detailed analysis of GameStop’s financials and market position that provided a bullish outlook on the company’s future. It became influential among retail investors and helped shape the narrative around GameStop’s potential.

How has GameStop’s business model changed since February 2021?

GameStop has pivoted towards e-commerce, expanded into NFTs and blockchain gaming, and made significant leadership changes to drive its digital transformation.

What role did social media play in the GameStop saga?

Social media platforms, particularly Reddit’s WallStreetBets forum, played a crucial role in coordinating retail investor activity and spreading information about GameStop.

Conclusion

The GameStop February October Irwin Decrypt phenomenon has left an indelible mark on the world of finance. It demonstrated the power of retail investors when organized through social media, challenged traditional valuation models, and highlighted the potential for struggling companies to reinvent themselves in the digital age.

Key takeaways from the GameStop saga include:

- The democratization of finance through social media and commission-free trading platforms

- The potential vulnerabilities in traditional short-selling strategies

- The importance of adapting to digital trends, even for established brick-and-mortar businesses

- The power of narrative and community in driving investment decisions

As GameStop continues to evolve, the lessons learned from this saga will likely influence how future market movements are perceived and understood. The power of retail investors, the impact of social media, and the importance of thorough analysis—as exemplified by the Irwin Decrypt—will be remembered as key factors in this extraordinary chapter of financial history.

Whether GameStop will ultimately live up to the lofty expectations set by the Irwin Decrypt remains to be seen. However, one thing is certain: the journey from February to October 2021 has forever changed the conversation around retail investing, market dynamics, and the potential for digital transformation in traditional industries. As we move forward, the GameStop story serves as a testament to the unpredictable nature of markets in the digital age and the enduring power of innovation and community in shaping financial narratives.

Explore the latest news and insights from Vibrant’s and beyond at Vibrantsvista.com